Canadian Immigration Updates

Applicants to Master’s and Doctoral degrees are not affected by the recently announced cap on study permits. Review more details

Overview

Research and collaboration are at the heart of the UBC Business Administration in Accounting PhD program. Here, you will be equipped with the in-depth knowledge, communication skills, and immersive research capabilities you’ll need to be at the forefront of your discipline.

Right from the outset of the program, you will receive individualized attention, guidance, and mentorship from our faculty. Not only will they enrich your knowledge and build your skillset, our faculty will be your support network as you as you integrate yourself into a vibrant academic community.

What makes the program unique?

The research faculty in Accounting publish in the top journals in the field, and engage in empirical research in financial accounting, auditing and taxation. Our program draws effectively on strong research faculty in other fields, including finance, economics, policy analysis, and management science. Of particular importance are the variety of research workshops held each week which expose students to current research by leading researchers from UBC and other universities in accounting and the related fields.

The program attracts some of the world’s sharpest, most curious minds who, over the course of the program, sharpen their skills and deepen their knowledge. Upon graduating, you will:

- Have in-depth knowledge of the process of scientific discovery and the Philosophy of Science (epistemology), which you will be able to apply to your research discipline.

- Be a skilled communicator with the ability to share your knowledge and expertise effectively with a variety of audiences. You will be able to present your findings at a research seminar or a conference, to teach a complete course effectively, and be able to publish in the academic genre of your discipline.

- Have the appropriate analytical research foundation for your chosen area of specialization, and you will be able to apply your analytical knowledge and skills to research problems in that area.

- Have an in-depth understanding of leading research within your chosen area of specialization, and you will be able to enrich and advance that body of knowledge through deep analysis and synthesis of research problems and findings.

Program Structure

Students are required to take a cross-divisional course in research methods, a course in teaching methods, and the following four courses in the accounting division.:

- COMM 651 Analysis of Accounting Information in Markets. An examination of theoretical research into the role of public accounting information in capital markets and its relation to market prices, and the impact and disclosure of private investor and private management information.

- COMM 657 Empirical Methods in Accounting Research. An introduction to empirical accounting research, emphasizing the use of theoretical arguments in developing testable hypotheses, econometric methodologies used to address accounting research problems and data issues that arise in testing hypotheses.

- COMM 658 Research Workshop in Accounting. Discussion of accounting research presented by faculty and PhD students from UBC and other universities.

- COMM 659 Advanced Topics in Empirical Accounting Research. A selection of special topics in accounting research. The exact topics covered depend on the research expertise of the faculty members teaching the course in any given year.

You select your remaining coursework from other divisions and departments such as Finance, Economics and Mathematics, with the guidance of the PhD advisor.

You begin active research in the first year of your program by completing a summer research project. Most students write their comprehensive examination after their second year of course-work and spend the remainder of the program working on their dissertation research.

Quick Facts

Program Enquiries

Contact the program

Admission Information & Requirements

1) Check Eligibility

Minimum Academic Requirements

The Faculty of Graduate and Postdoctoral Studies establishes the minimum admission requirements common to all applicants, usually a minimum overall average in the B+ range (76% at UBC). The graduate program that you are applying to may have additional requirements. Please review the specific requirements for applicants with credentials from institutions in:

Each program may set higher academic minimum requirements. Please review the program website carefully to understand the program requirements. Meeting the minimum requirements does not guarantee admission as it is a competitive process.

English Language Test

Applicants from a university outside Canada in which English is not the primary language of instruction must provide results of an English language proficiency examination as part of their application. Tests must have been taken within the last 24 months at the time of submission of your application.

Minimum requirements for the two most common English language proficiency tests to apply to this program are listed below:

TOEFL: Test of English as a Foreign Language - internet-based

Overall score requirement: 100

Reading

22

Writing

21

Speaking

21

Listening

22

IELTS: International English Language Testing System

Overall score requirement: 7.0

Reading

6.5

Writing

6.5

Speaking

6.5

Listening

6.5

Other Test Scores

Some programs require additional test scores such as the Graduate Record Examination (GRE) or the Graduate Management Test (GMAT). The requirements for this program are:

The GRE or a comparable test is required. Please check the program website.

Prior degree, course and other requirements

Course Requirements

Most students have had prior studies in accounting, but some have entered into the program with backgrounds primarily in finance, economics, or mathematics and then developed their understanding of accounting by taking appropriate undergraduate or Masters' courses in accounting.

2) Meet Deadlines

3) Prepare Application

Transcripts

All applicants have to submit transcripts from all past post-secondary study. Document submission requirements depend on whether your institution of study is within Canada or outside of Canada.

Letters of Reference

A minimum of three references are required for application to graduate programs at UBC. References should be requested from individuals who are prepared to provide a report on your academic ability and qualifications.

Statement of Interest

Many programs require a statement of interest, sometimes called a "statement of intent", "description of research interests" or something similar.

Supervision

Students in research-based programs usually require a faculty member to function as their thesis supervisor. Please follow the instructions provided by each program whether applicants should contact faculty members.

Instructions regarding thesis supervisor contact for Doctor of Philosophy in Business Administration in Accounting (PhD)

Citizenship Verification

Permanent Residents of Canada must provide a clear photocopy of both sides of the Permanent Resident card.

4) Apply Online

All applicants must complete an online application form and pay the application fee to be considered for admission to UBC.

Tuition & Financial Support

Tuition

| Fees | Canadian Citizen / Permanent Resident / Refugee / Diplomat | International |

|---|---|---|

| Application Fee | $114.00 | $168.25 |

| Tuition * | ||

| Installments per year | 3 | 3 |

| Tuition per installment | $1,838.57 | $3,230.06 |

| Tuition per year (plus annual increase, usually 2%-5%) | $5,515.71 | $9,690.18 |

| Int. Tuition Award (ITA) per year (if eligible) | $3,200.00 (-) | |

| Other Fees and Costs | ||

| Student Fees (yearly) | $1,116.60 (approx.) | |

| Costs of living | Estimate your costs of living with our interactive tool in order to start developing a financial plan for your graduate studies. | |

All fees for the year are subject to adjustment and UBC reserves the right to change any fees without notice at any time, including tuition and student fees. Tuition fees are reviewed annually by the UBC Board of Governors. In recent years, tuition increases have been 2% for continuing domestic students and between 2% and 5% for continuing international students. New students may see higher increases in tuition. Admitted students who defer their admission are subject to the potentially higher tuition fees for incoming students effective at the later program start date. In case of a discrepancy between this webpage and the UBC Calendar, the UBC Calendar entry will be held to be correct.

Financial Support

Applicants to UBC have access to a variety of funding options, including merit-based (i.e. based on your academic performance) and need-based (i.e. based on your financial situation) opportunities.

Program Funding Packages

We provide a financial package that includes tuition plus $30,000 per year for the first five years of the PhD Program.

Average Funding

- 3 students received Research Assistantships. Average RA funding based on 3 students was $15,718.

- 1 student received Academic Assistantships valued at $2,400.

- 3 students received internal awards. Average internal award funding based on 3 students was $19,606.

Review methodology

Scholarships & awards (merit-based funding)

All applicants are encouraged to review the awards listing to identify potential opportunities to fund their graduate education. The database lists merit-based scholarships and awards and allows for filtering by various criteria, such as domestic vs. international or degree level.

Graduate Research Assistantships (GRA)

Many professors are able to provide Research Assistantships (GRA) from their research grants to support full-time graduate students studying under their supervision. The duties constitute part of the student's graduate degree requirements. A Graduate Research Assistantship is considered a form of fellowship for a period of graduate study and is therefore not covered by a collective agreement. Stipends vary widely, and are dependent on the field of study and the type of research grant from which the assistantship is being funded.

Graduate Teaching Assistantships (GTA)

Graduate programs may have Teaching Assistantships available for registered full-time graduate students. Full teaching assistantships involve 12 hours work per week in preparation, lecturing, or laboratory instruction although many graduate programs offer partial TA appointments at less than 12 hours per week. Teaching assistantship rates are set by collective bargaining between the University and the Teaching Assistants' Union.

Graduate Academic Assistantships (GAA)

Academic Assistantships are employment opportunities to perform work that is relevant to the university or to an individual faculty member, but not to support the student’s graduate research and thesis. Wages are considered regular earnings and when paid monthly, include vacation pay.

Financial aid (need-based funding)

Canadian and US applicants may qualify for governmental loans to finance their studies. Please review eligibility and types of loans.

All students may be able to access private sector or bank loans.

Foreign government scholarships

Many foreign governments provide support to their citizens in pursuing education abroad. International applicants should check the various governmental resources in their home country, such as the Department of Education, for available scholarships.

Working while studying

The possibility to pursue work to supplement income may depend on the demands the program has on students. It should be carefully weighed if work leads to prolonged program durations or whether work placements can be meaningfully embedded into a program.

International students enrolled as full-time students with a valid study permit can work on campus for unlimited hours and work off-campus for no more than 20 hours a week.

A good starting point to explore student jobs is the UBC Work Learn program or a Co-Op placement.

Tax credits and RRSP withdrawals

Students with taxable income in Canada may be able to claim federal or provincial tax credits.

Canadian residents with RRSP accounts may be able to use the Lifelong Learning Plan (LLP) which allows students to withdraw amounts from their registered retirement savings plan (RRSPs) to finance full-time training or education for themselves or their partner.

Please review Filing taxes in Canada on the student services website for more information.

Cost Estimator

Applicants have access to the cost estimator to develop a financial plan that takes into account various income sources and expenses.

Career Outcomes

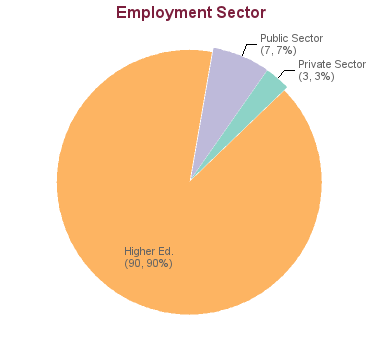

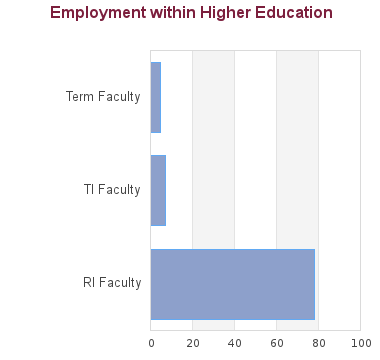

102 students graduated between 2005 and 2013. Of these, career information was obtained for 100 alumni (based on research conducted between Feb-May 2016):

RI (Research-Intensive) Faculty: typically tenure-track faculty positions (equivalent of the North American Assistant Professor, Associate Professor, and Professor positions) in PhD-granting institutions

TI (Teaching-Intensive) Faculty: typically full-time faculty positions in colleges or in institutions not granting PhDs, and teaching faculty at PhD-granting institutions

Term Faculty: faculty in term appointments (e.g. sessional lecturers, visiting assistant professors, etc.)

Sample Employers in Higher Education

Western University (Ontario) (5)City University of Hong Kong (5)

University of Manitoba (3)

University of British Columbia (3)

Simon Fraser University (3)

University of International Business and Economics (3)

Arizona State University (2)

Boston College (2)

University of Toronto (2)

University of Ottawa (2)

Sample Employers Outside Higher Education

Banco de México (2)Bank of Canada (2)

IBM Research

Ministry of Education - Guyana

Ontario Public Service

Government of the Republic of China (Taiwan)

Royal Bank of Canada

Sample Job Titles Outside Higher Education

Strategic ICT SpecialistSenior Economist

Research Scientist

Senior Financial Specialist

Economic Staff

Consultant / Analyst

Information Organization Manager

Deputy Executive Secretary

Assistant Chief

Head of Research

PhD Career Outcome Survey

You may view the full report on career outcomes of UBC PhD graduates on outcomes.grad.ubc.ca.Disclaimer

The data show all specializations in Business Administration combined. These data represent historical employment information and do not guarantee future employment prospects for graduates of this program. They are for informational purposes only. Data were collected through either alumni surveys or internet research.Enrolment, Duration & Other Stats

These statistics show data for the Doctor of Philosophy in Business Administration in Accounting (PhD). Data are separated for each degree program combination. You may view data for other degree options in the respective program profile.

ENROLMENT DATA

| 2023 | 2022 | 2021 | 2020 | 2019 | |

|---|---|---|---|---|---|

| Applications | 35 | 0 | 43 | 0 | 33 |

| Offers | 3 | 0 | 4 | 0 | 3 |

| New Registrations | 0 | 0 | 2 | 0 | 2 |

| Total Enrolment | 4 | 4 | 7 | 5 | 6 |

Disclaimer

Research Supervisors

Supervision

Students in research-based programs usually require a faculty member to function as their thesis supervisor. Please follow the instructions provided by each program whether applicants should contact faculty members.

Instructions regarding thesis supervisor contact for Doctor of Philosophy in Business Administration in Accounting (PhD)

This list shows faculty members with full supervisory privileges who are affiliated with this program. It is not a comprehensive list of all potential supervisors as faculty from other programs or faculty members without full supervisory privileges can request approvals to supervise graduate students in this program.

-

Cavusoglu, Hasan (IT investment, information security, value of information technology, online product differentiation, information system security, Economics & sustainability, Management Information Systems)

-

Cenfetelli, Ronald Timothy (Human computer interaction, E-Business, IT-mediated customer service, Negative aspects of technology, Structural equation modeling, Survey research techniques, Multi-level modeling)

-

Chamberlain, Sandra (Accounting and the economics of, Valuation of publicly traded firms using accounting information, Accounting and contracting, Earnings quality, Accounting for Financial Institutions)

-

D Adduzio, Jenna (Voluntary and mandatory disclosures; Regulatory and standard setting issues; Disclosure materiality)

-

Lee, Gene (Economics and business administration; Management information systems; Applied Machine Learning; Business Analytics; Computer Science and Statistics; Cybersecurity; Information Systems; Mobile Ecosystem; Social Media Analysis; Text Mining)

-

Lo, Kin (financial reports; financial disclosures; financial statements; accounting; stock options; executive compensation; auditing; stock valuation; securities regulation; tax planning; tax policy, Empirical research in financial accounting and reporting, Investigating the motives and effects of voluntary disclosures, The effects of alternative regulated reporting regimes, Refinement of accounting research methodology, Examining the role of accounting in equity valuation)

-

Lundholm, Russell (Financial statement analysis )

-

Nan, Ning (Economics and business administration; Management information systems; blockchain governance; complex adaptive systems; digital business; evolvable information systems; Information Systems; Management; online community)

-

Swanson, David (Finance; Economics of Regulation; Political Economics; SEC; Securities Litigation)

-

Vijayaraghavan, Rajesh (Accounting and risk management in financial institutions, Disclosure, Corporate governance and performance measurement, Corporate Finance, Applications of machine learning)

-

Woo, Carson C (Management information systems; Applications of block chain and artificial intelligence technology to business; Conceptual modeling; Information Systems; Information systems analysis and design; Philosophy of Design Science; Requirements engineering)

-

Yan, Han (Accounting; Financial economics; Banking; Climate Finance; Voluntary Disclosure; Earnings Quality; Reduced Form and Structural Estimation)

-

Yeung, Ira (Voluntary Disclosure; Information Quality; Financial Institutions)

-

Zhang, Jenny Li (Accounting; Economics and business administration; Management information systems; Finance and Accounting; Financial reporting, corporate disclosure, restatements, pension)

-

Zheng, Xin (SEC Enforcement, Securities Litigation, Auditing, Fraud, Regulation, Financial Reporting)

Doctoral Citations

| Year | Citation |

|---|---|

| 2018 | Dr. Zhang examined the financial reporting of foreign firms and foreign auditors in the U.S. He found that foreign firms are subject to less frequent monitoring than U.S. firms and foreign auditors provide quality as good as the U.S. non-Big4 auditors. Findings address recent concern over the quality of foreign auditors practicing in the U.S. |

Sample Thesis Submissions

Further Information

Specialization

Within accounting faculty engage in empirical research in financial accounting, auditing, and taxation.

Program Website

Faculty Overview

Academic Unit

Program Identifier

Program Enquiries

Contact the program

Departments/Programs may update graduate degree program details through the Faculty & Staff portal. To update contact details for application inquiries, please use this form.

Experience the colours of Vancouver

Great academic programs, great location: the distinct seasons and mild climate are among the reasons why graduate students choose to study here -- from the autumn leaves to cherry blossoms, witness the many colours Vancouver has to offer.